1000+ performances in 40+ countries worldwide

He’s one of Europe’s most trusted voices, find out why

Speaking topics

When everyone has access to advanced technology, it is no longer a competitive advantage. In a world of artificial intelligence, competition will be all about opinions, emotions, and fantasy – all that we call human intelligence.

Sustainability used to be a problem, a cost, or perhaps a charity project. Today everybody, from investors to customers, is searching for the next Tesla. The race toward zero has started.

Remote work is not about the workplace but rather about a change in leadership. When work is no longer a place, the team has to morph from self-organizing to self-leading.

One of the inevitable conclusions of disruption is the falling value of experience. So when we address the increased speed of change, we must focus on creating a culture brave enough to challenge experience.

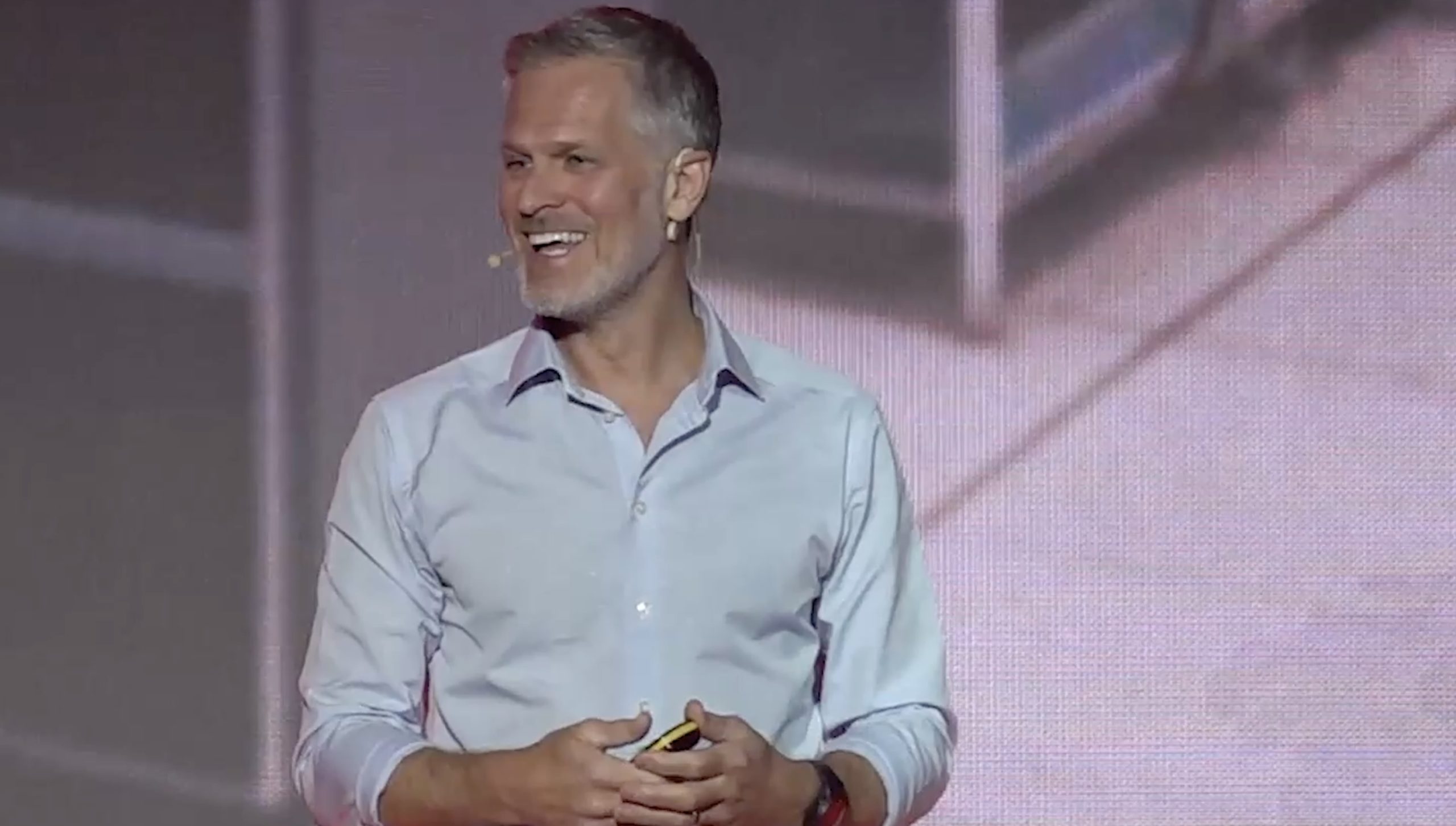

The futurist

We live in the most exciting of times. The internet has connected people all over the world and laid the foundation for a new society. Civilization can build on cooperation without traditional hierarchies for the first time in history.

And with AI, we enhance human possibilities to acquire knowledge and solve problems. Soon, we will all have a super-smart assistant for decision-making available around the clock at no cost.

Digitalization and the green revolution are rapidly challenging all our old models. We are now building an entirely new world at record speed.

Our problems are numerous, but humans have always grappled with challenges. However, the opportunities of the 21st century are of an entirely new nature. The possibilities are greater than our dreams.

Stefan Hyttfors has been described as “The best on stage after Hans Rosling.” He lectures on current trends that are changing the world, always with a focus on relevance for those listening. Stefan can be booked as a keynote speaker.

News & Inspiration